The Federal Reserve cut its benchmark interest rate a quarter of a percentage point on Wednesday, opting for its third interest rate cut this year in an effort to revive a sluggish labor market.

The reduction of interest rates could deliver some relief for mortgage and credit card borrowers.

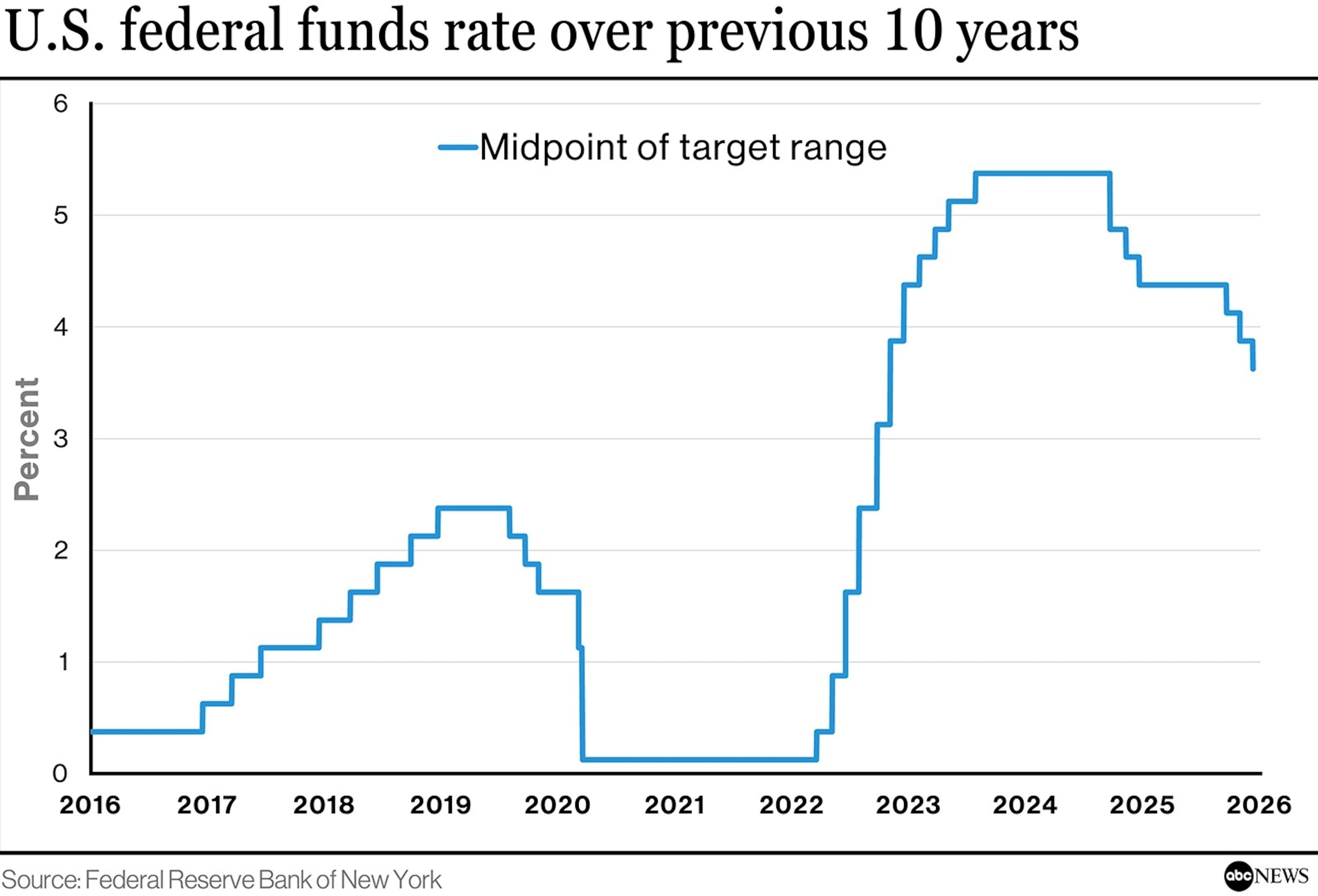

The Fed’s benchmark rate stands between 3.5% and 3.75%. That figure marks a significant drop from a recent peak attained in 2023, but borrowing costs remain well above a 0% rate established at the outset of the COVID-19 pandemic.

Speaking at a press conference in Washington, D.C., on Wednesday, Fed Chair Jerome Powell touted the rate cut as an effort to improve the labor market, but he suggested the central bank may be cautious about further rate reductions.

“We’re well positioned to wait and see how the economy evolves,” Powell said.

Top officials at the Federal Reserve displayed a rare degree of public disagreement over the weeks leading up to the latest rate decision. Three of the 12 voting members on the Federal Open Market Committee — a policymaking body at the Fed — dissented from the quarter-point rate cut, the highest number of dissenters since 2019.

Inflation has picked up in recent months alongside the hiring slowdown, posing a risk of an economic double-whammy known as “stagflation.”

The Fed is stuck in a bind, since the central bank must balance a dual mandate to keep inflation under control and maximize employment. To address pressure on both of its goals, the Fed primarily holds a single tool: interest rates.

The pressure on both sides of the Fed’s dual mandate present a “challenging situation” for the central bank, Powell said.

“There’s no risk-free path for policy as we navigate this tension between our employment and inflation goals,” Powell added.

If the Fed had held interest rates steady as a means of protecting against tariff-induced inflation, it risked a deeper slowdown of the labor market. On the other hand, by lowering rates to stimulate hiring, the Fed threatens to boost spending and worsen inflation.

Trump backtracks on releasing boat strike video, distances himself from controversy

Lately, sentiment shifted in favor of a rate cut as some influential central bankers voiced openness toward the move, futures markets showed.

Hours before the rate decision, the odds of a quarter-point interest rate cut stood at nearly 90%, surging from a level as low as 30% last month, according to CME FedWatch Tool, a measure of market sentiment.

The prospects appeared to move in response to a murky jobs report and public statements from two allies of Powell on the committee charged with setting rates.

Last month, a jobs report for September sent mixed signals about the labor market. Employers added far more workers than expected in September, though hiring fell short of a breakneck clip. Meanwhile the unemployment rate ticked up to 4.4%, a low figure by historical standards but the highest recorded since October 2021.

Judge grants DOJ motion to release grand jury materials from Ghislaine Maxwell case

New York Fed President John Williams, who is often in lockstep with Powell, days later voiced openness toward a rate cut, telling reporters he still saw “room for a further adjustment in the near term.”

Soon afterward, San Francisco Fed President Mary Daly took a similar position, telling reporters she sees room “for a further adjustment in the near term.” Daley, who isn’t voting on interest rates this year, is widely viewed as a supporter of Powell.